Thank you: your free tip will be with you in a few minutes.

In the meantime, I wonder if you'll be my 'guinea pig?'

Could I share 5 brand new, carefully researched UK share tips from the Trendwatch team with you for just £1?

(Be quick - you will never see this 'welcome' offer again...

...and this offer is limited to the first 30 people to apply only!)

Hi, Trendwatch editor Rob Cullum here.

May I share with you our 5 newest share recommendations?

* Tip 1 - this AIM-listed company is at the leading edge of the next internet revolution

* Tip 2 - THE must-have share to capitalise on infrastructure spending

* Tip 3 - placed strategically at the heart of the gaming industry, with an attractive yield

* Tip 4 - this emerging pharma company caught our eye some time ago - it's now on the cusp of achieving critical mass

* Tip 5 - the name may sound familiar - but you probably don't realise the current scope or scale of its operations, and there's a lot to like!

Ordinarily, membership of my premium Trendwatch newsletter:

...trusted by our loyal members since 2000 and which now gives private investors like you SIX carefully researched share recommendations per month...

...is a minimum of £29 per month to join.

But right now, I'm in the midst of a little experiment...

... and making 30 one-month trials of Trendwatch available for just £1...

HOWEVER:

a) there are only 30 trials up for grabs.

b) once the 30 are gone, we'll close this offer - so best to act now!

When you join you'll get access to:

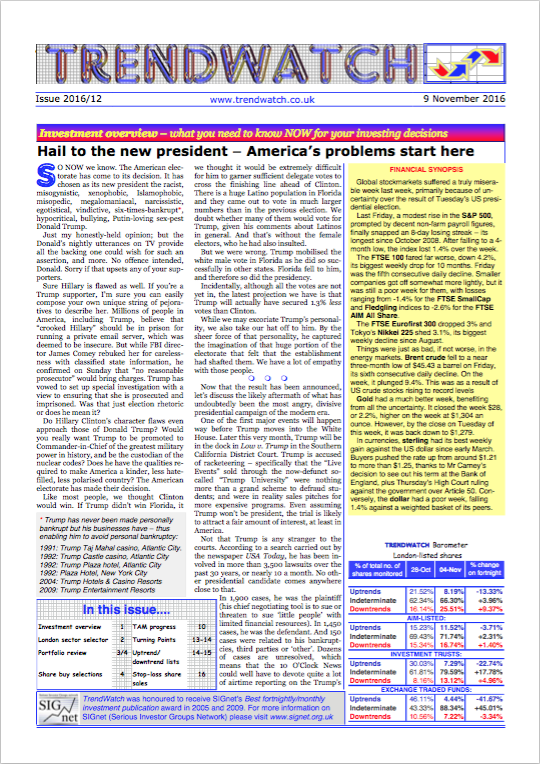

>>> The latest, full edition of Trendwatch featuring SIX new, carefully-researched 'buy' recommendations...

...yes, you'll be able to download the latest 16 page magazine instantly in a moment and get all our latest share tips, right now.

>>> And, on every fourth Wednesday after that...

...a brand new, 16 page edition, featuring SIX brand new carefully-researched 'buy' recommendations will wing it's way to you, by email...

>>> Every issue, you get a complete list of shares in uptrend and downtrend...

...a fantastic investment tool. We even tell you how long the share has been in its trend.

>>> Why are the uptrend/downtrend lists so important?

Well, imagine a share – any share – that has doubled in value.

Its long uptrend had to start somewhere, but you almost certainly missed it when it began...

>> But now imagine how much more successful your investing would be...

...if you never ever missed shares that had just started their uptrend...

>>> ...you’d be able to get in near the bottom....

....ride the uptrend until it started to break down, then take your profit...

>>> You'll also get three Weekly Updates...

...which ensure that your uptrend and downtrend lists are always up to date

>>> Acerbic commentary on the latest state of the markets...

>>> All written in a friendly and easily accessible style...

...with the minimum of technical jargon...

...yet it doesn't insult your intelligence by dumbing down!

Note: this is an ongoing membership, designed ONLY for private investors serious about growing their wealth.

After the trial, normal rates of £29/month apply - but you are in complete control!

You can stay for as long or as little as you like.

Most members have a long stay with us - in fact many have been with us since our inception in 2000 (see our member feedback below).

But if you wish to cancel at any stage, you just need to reply to any of the emails we send you.

All we ask is that you give us at least a couple of working days' notice before your next payment is due if you want to avoid that payment.

When you try us out, you'll be joining our happy band of Trendwatch members, who say things like:

"I value Trendwatch a lot. It is the first time in many years' share dealing that I am doing well, thanks to you!" (J.C., Devon)

"I wish to applaud you for the excellent quality of your newsletter. You will be pleased to know that it has earned me a lot of money." (T.D., SE London)

"I remember in the past you said that a skilful investor could make 15%-20% per annum but your recent recommendations have done exactly that much in 2 months!

Your stock picking skills are excellent and your research is brilliant… you are clever at finding companies that have something in the pipeline...

If it was just luck or coincidental then you wouldn't have the returns we are seeing over such a long period of time." (N.M., Watford)

"Thanks for an excellent publication. Not only is it an enjoyable and informative read but it has also proved to be profitable. " (C.F., Hampshire)

"I'm most impressed by your publication, and I have just about re-structured my entire portfolio around it. (E.B., Grantham)

"Trendwatch serves me well – I read every word with interest, and a significant part of your portfolio is always in mine – thank you." (D.M., Hertfordshire)

"Thank you for your amazingly prompt and detailed reply to my stop-loss query... having had a personal reply so quickly from a busy editor, I'm even more impressed by Trendwatch" (J.L., SW London)

“I like TrendWatch, which I think has more integritythan any such publication I have read or seen.” (J.H., Suffolk)

"Having spent the last two weeks battling with BT, it is refreshing to deal with a company focused on real customer care." (K.S., Bath)

"I would like to take this opportunity to inform you that I am extremely pleased with your publication, which I have found to be extremely profitable with 15 of your recommendations in which I have invested over this past year…

Thank you for an excellent publication." (J.T., Hastings)

"If I had to describe TrendWatch I would use the words: excellent, instructive and invaluable. I subscribed to two other publications before yours, and used to read others on a regular basis. Trendwatch is the only one I will subscribe to in the future." (D.Y., Edinburgh)

You have nothing to lose (well, OK - a measly pound!) by giving it a shot.

Thanks and I'll see you on the other side...

...you'll be able to download the latest issue of Trendwatch in PDF format immediately, and you'll then get all our other updates and new issues by email."

Rob Cullum

Editor

Trendwatch

P.S. I fully expect you to love and value Trendwatch as much as every one of our loyal subscribers.

But if you decide you don't feel the same, remember: you just need to contact us by replying to any of our emails, or through our contact form here, and we can end your membership immediately.

Thank you for giving us a try and I look forward to welcoming you to the service!

IMPORTANT: Share prices can go down as well as up. You will not necessarily get back the amount you invested. The past is not necessarily a guide to future performance. Prices of some small investments may be especially volatile and the difference between the bid and offer price may be wide. These trading products may not be suitable for all investors so seek independent advice. Trendwatch Asset Management takes your privacy very seriously. We will never sell, share or otherwise misuse your personal data. TrendWatch Asset Management Ltd is authorised and regulated by the Financial Conduct Authority (FCA firm no: 414207) and registered in England and Wales, company no: 4704606. Registered office: 6b Parkway, Porters Wood, St Albans, Hertfordshire, AL3 6PA. Telephone: +44 (0)1727 762 629.